Margin call price calculator

The SPAN margin and the. For example most forex brokers say they require 2 1 5 or 25 margin.

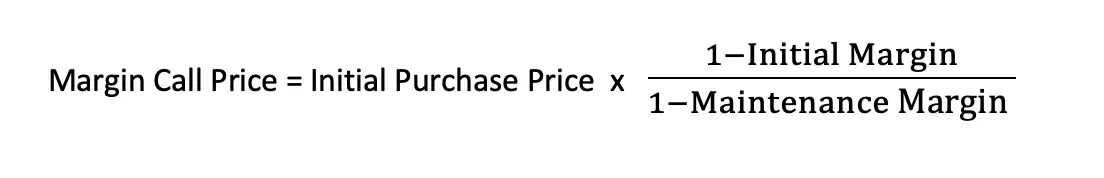

Margin Call Price Formula And Calculator

A margin call.

. The calculations given by the margin calculator tool are only a guide. The exposure margin provides an additional safety net to brokers over and above the SPAN margin. Such as the dreaded margin call its important to.

To fall below a pre-defined stop out percentage one or all open positions are automatically closed by the broker. Clients are not permitted to place any securities with the broker or associate of the broker or authorized person of the broker for any reason. Price Elasticity of Demand 4385 98.

Free Margin is the difference between Equity and Used Margin. Margin is usually expressed as a percentage of the full amount of the position. In this trading scenario your retail forex broker has a Margin Call Level of 100 and a Stop Out Level of 20.

What does Free Margin mean. ABC is currently achieving a 65 percent gross profit in her furniture business. The gross profit margin.

If you trade using the full 1001 leverage a price movement of 100 times less will produce the same profit or loss. Robinhood TD Ameritrade Etrade Webull Fidelity Charles Schwab Vanguard IB. If your broker requires a 2 margin you have a leverage of 501.

ASCII characters only characters found on a standard US keyboard. Many business owners will use gross profit margin calculations to help them price their products track changes over time and even take a closer look at some of the various cost factors that go into the cost of goods sold number that is input into the calculation to arrive at the gross profit margin calculation. FREE formatting APA MLA Harvard ChicagoTurabian 24x7 support.

Select your currency pair account currency deposit base currency and margin leverage ratio input your trade size in units 1 lot 100000 units and click calculate. Exposure margin calculator. If the stock price rises and other pricing variables remain constant then the price for the call will go up.

It is usually fixed and calculated as 3 per cent of the contract value. If you want to customize the colors size and more to better fit your site then pricing starts at just 29. The Consumer Price Index CPI.

The calculator will use the current real-time prices for exact values. You can use our calculator above which uses the Black Scholes formula to estimate the value of a long call purchase before or at expiry. A margin call is a warning that you need to bring your margin account back into good standing.

Which means you wont borrow 50 of the purchase price. Welcome to the Margin Calculator. 6 to 30 characters long.

The margin call calculator exactly as you see it above is 100 free for you to use. Total Margin Required 000. If the stock goes down 1.

I Sell CALL 1 Lot of Strike Price 7500 at 10Rs premium eachIt needs additional Margin of Rs. CD Calculator Compound Interest Calculator Savings Calculator. Used Margin which is just the aggregate of all the Required Margin from all open positions was discussed in a previous lesson.

The law of demand states that as the price of the commodity or the product increases the demand for that product or the commodity will eventually decrease all conditions being equal. How to calculate margin. Review your writers samples.

Free Margin refers to the Equity in a traders account that is NOT tied up in margin for current open. The price to earnings ratio calculator exactly as you see it above is 100 free for you to use. You can contact us any time of day and night with any questions.

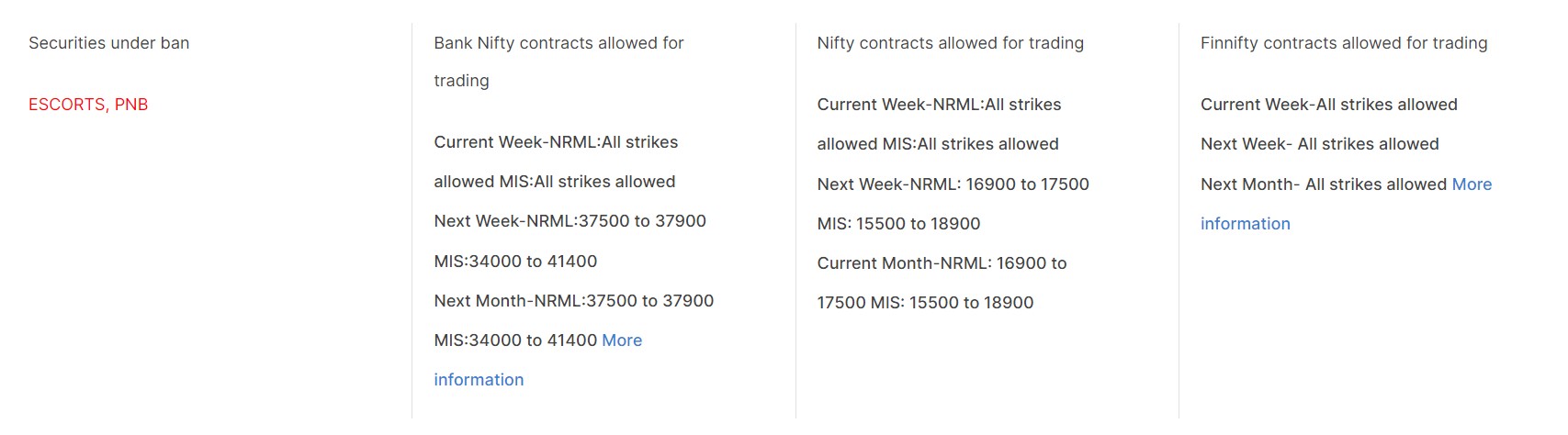

Put option writing also requires margin to be paid by the option writer. Unit contribution margin per unit denotes the profit potential of a product or activity from the sale of each unit to cover per-unit fixed cost and generate profit for the firm. Securities offered as margin collateral MUST remain in the account of the client and can be pledged to the broker only by way of margin pledge created in the Depository system.

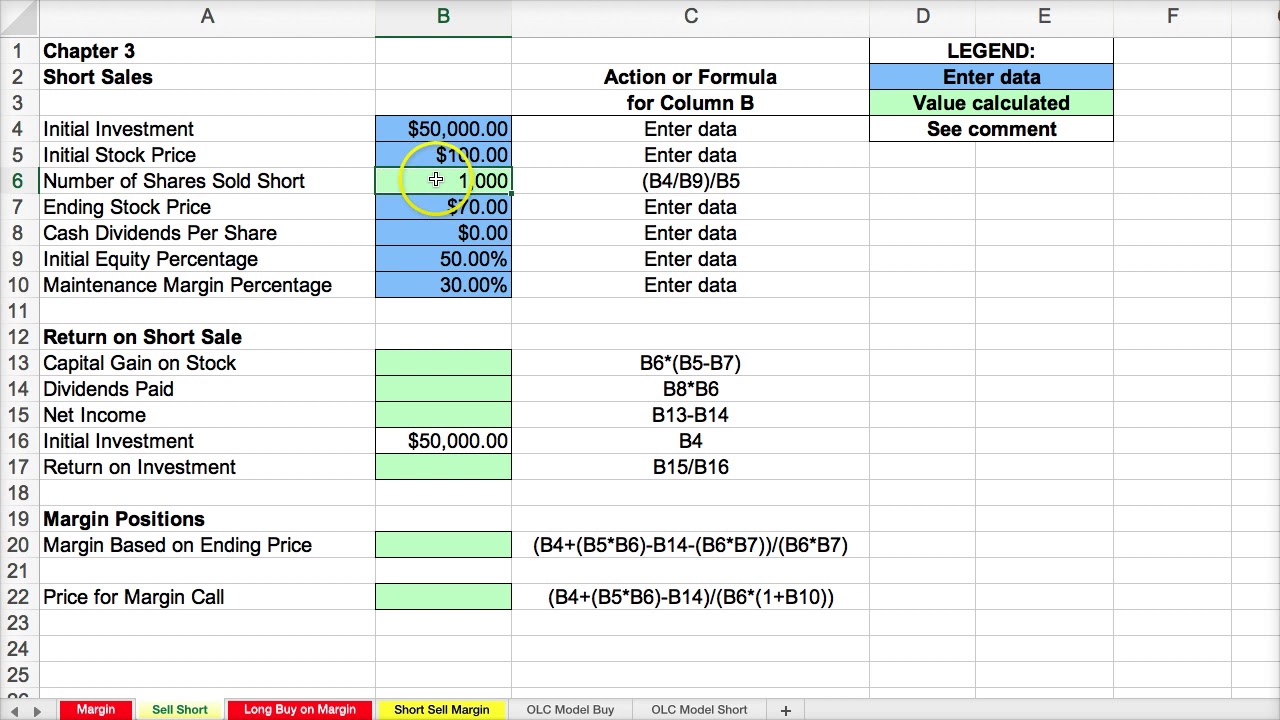

Must contain at least 4 different symbols. Stock Quantity Remove. To use our free Margin Call Calculator just enter in the stock share price initial margin percentage and the stock maintenance margin percentage.

The SPAN margin calculator would give you different values depending on the time of day that you use the calculator. Gross Profit Margin can be calculated by using Gross Profit Margin Formula as follows Gross Profit Margin Formula Net Sales-Cost of Raw Materials Net Sales Gross Profit Margin 100000- 35000 100000 Gross Profit Margin 65. Profit stock price - strike price - option cost time value 100 number of contracts extrinsic premium is any cost above the intrinsic value.

With Ultra Trade Pack 000. Calculate comprehensive Span margin required for future options with the help of span margin calculator. Price Elasticity of Demand 045 Explanation of the Price Elasticity formula.

Stock margin interest loanrate calculator. Position Size Calculator Practice proper position sizing. Well always be happy to help you out.

Eg a firm sells a product at Rs 10 per piece and incurred variable costs per unit Rs. If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a one time purchase. See how selling a position or depositing money can cover the outstanding call due if youre in a margin call.

Margin can be classified as either used or free. Zerodha FO margin Calculator part of our initiative Zerodha Margins is the first online tool in India that lets you calculate comprehensive margin requirements for option writingshorting. How much a large buy or sell order affects the price of the scrip also known as impact.

The Hypothetical Transaction Tool and the Price Change Tool attempt to show the impact on your margin requirements and balances based on transactions andor security price movements that you. When using the above margin loan calculator be sure to specify the correct borrowed amount. Or to 20000 to double your investment.

Based on the margin required by your broker you can calculate the maximum leverage you can wield with your trading account. Please speak to an independent financial advisor for professional guidance. Put Add Reset.

91-9310400612 0120-4200026 Mail Us. Theoretically the buyer of the Put option can make a profit limited to the spot price of the underlying less Premium paid say for example A Ltd is trading for Rs105 You buy a Put contract of A with strike price 100 paying Rs2 as premium. Click the Customize button above to learn more.

Now that we know what the Margin Call and Stop Out Levels are lets find out if trading with 100 is doable. Forex Crypto Margin Leverage Calculator. For exampleIf a call has a delta of 075 and the stock goes up 1 in theory the price of the call will go up about 075.

Every sweet feature you might think of is already included in the price so there will be no unpleasant surprises at the checkout.

Margin Calculator Part 1 Varsity By Zerodha

Margin Call Price Formula And Calculator

Margin Calculator Step By Step Instruction Fidelity Investments

Margin Call Price Formula And Calculator

Why Does The Span Calculator Show Na For Buy Options Trading Trading Q A By Zerodha All Your Queries On Trading And Markets Answered

Margin Calculator Step By Step Instruction Fidelity Investments

Prostocks F O Margin Calculator

Excel Margin And Short Sell Calculations Youtube

Margin Call Price Formula Example Accountinguide

Margin Everything You Need To Know Option Alpha

Margin Calculator Part 1 Varsity By Zerodha

What Is A Margin Calculator

What Is A Margin Call Margin Call Formula Example

Margin Call Price Formula And Calculator

What Is A Margin Calculator

How To Calculate Margin In Future Trading Free Margin Calculator By Zerodha Episode 25 Youtube

Prostocks F O Margin Calculator